WHAT IS TITLE?

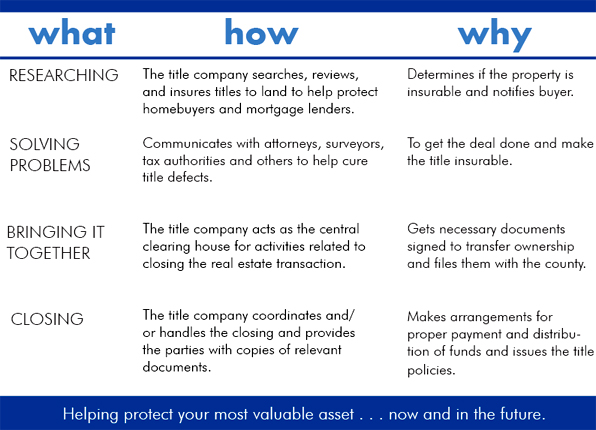

Title is your right to ownership and possession of your home or property. Title insurance helps protect you from problems that could affect your legal right to own your property. The title company helps uncover and fix problems and defects that could cause you to lose rights to your property.

WHAT HAPPENS IF THERE IS A PROBLEM?

The behind-the-scenes work of the title company promotes the efficient and secure transfer of real estate. Title insurance doesn’t guarantee that you won’t have a problem, but it does give you assurance that the title company will be there to help fix the problem or to compensate you financially on covered claims. Unlike other types of insurance, the title insurance premium is paid only once and lasts as long as you own the property.

A nationwide survey found that in 25% of real estate transactions there are defects in the title that are usually unknown.* If not remedied before you buy the property, these problems could hurt your right to own or enjoy the use of the property. Title companies pay millions of dollars each year in claims, losses and legal costs protecting the policy holders.

WHY IS TITLE INSURANCE SO IMPORTANT TO YOU AND YOUR FAMILY?

A title policy is your assurance that the home you’re buying is protected from covered title problems. It’s simply something you should have, so you can focus on all the other important issues that go with buying a home.